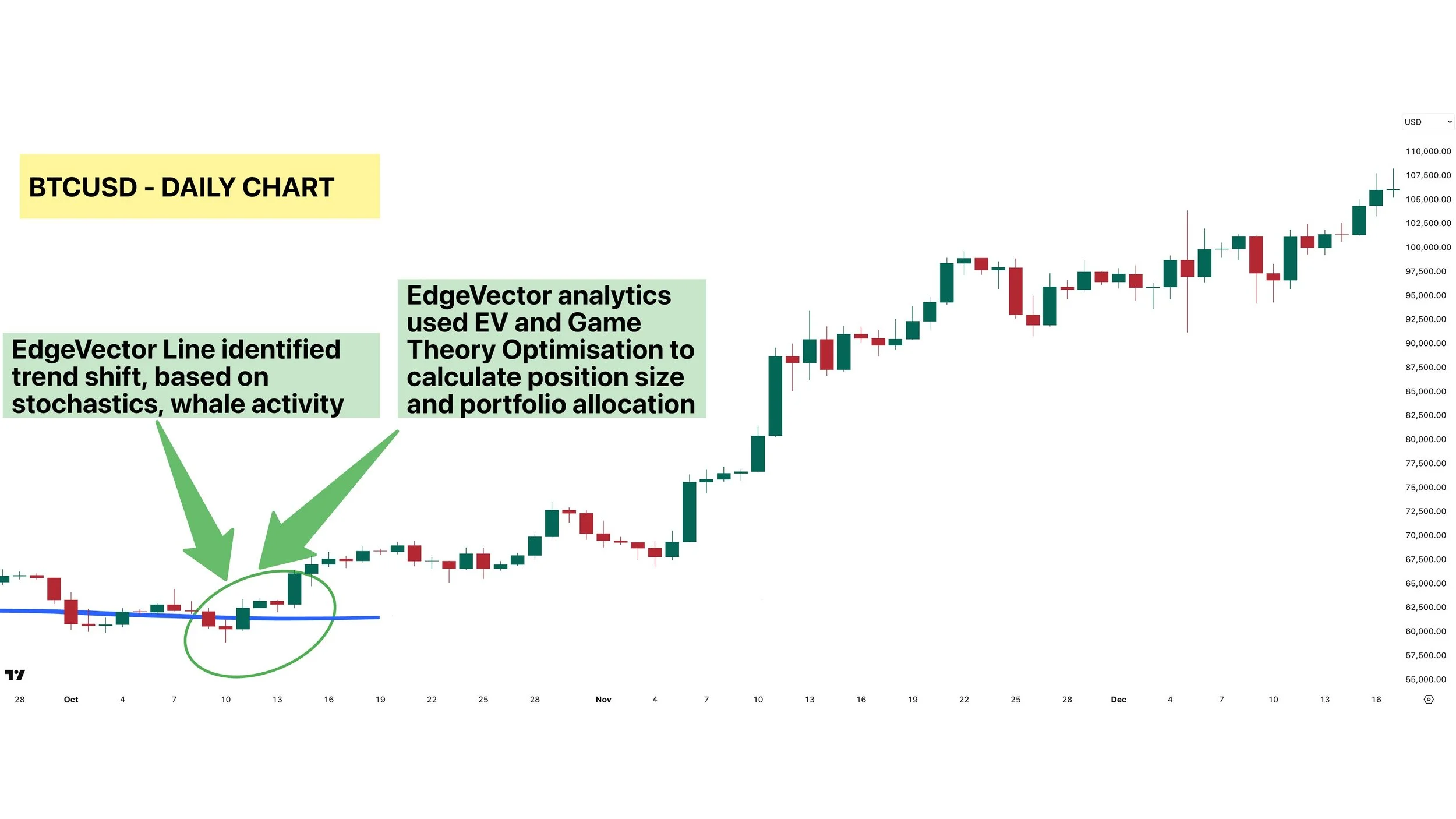

You’ve seen EdgeVector Line predict major market shifts.

Here’s what made it possible.

EdgeVector Line shifts dynamically as the market evolves.

You don’t just see the move, you understand, in real time why the odds flipped in your favor.

Still using these?

Here’s why they fail

| Indicator | Why It's Flawed | How EdgeVector Line Solves it |

|---|---|---|

| Moving Averages | Too Slow. Crossovers confirm after the move. | EdgeVector Line adapts dynamically - no waiting, no lag. |

| RSI & MACD | Momentum plays with no content. | EdgeVector Line filters signals through probability, not random swings. |

| Trend Indicators | Great when trends are strong, useless in chop. | EdgeVector Line shows when risk-reward is actually favorable. |

| Order Flow Tools | Requires deep knowledge and high-frequency trading. | EdgeVector Line simplifies decision-making without sacrificing precision. |

| Log Regression-Based Risk Models | Normalizes price, social, and on-chain data into a composite risk score. | Linear scaling doesn't adjust for real market dynamics. Fitting price to a log curve assumes past patterns repeat perfectly. |

| Normalization & Aggregation Models | Weights multiple factors (price, social, on-chain) into a single score. Looks sophisticated but is just linear scaling. | EdgeVector Line doesn't rely on static weights - it recalibrates dynamically based on real market shifts. |

| Quant-Based Sentiment Models | Tracks Twitter followers, YouTube subs, and other social trends. | Momentum chasers get wrecked when sentiment shifts. EdgeVector Line focuses on actual market positioning. |

Moving Averages

Why It's Flawed

Too Slow. Crossovers confirm after the move.

How EdgeVector Line Solves it

EdgeVector Line adapts dynamically - no waiting, no lag

RSI & MACD

Why It's Flawed

Momentum plays with no content.

How EdgeVector Line Solves it

EdgeVector Line filters signals through probability, not random swings

Trend Indicators

Why It's Flawed

Great when trends are strong, useless in chop.

How EdgeVector Line Solves it

EdgeVector Line shows when risk-reward is actually favorable

Order Flow Tools

Why It's Flawed

Requires deep knowledge & high-frequency trading

How EdgeVector Line Solves it

EdgeVector Line simplifies decision-making without sacrificing precision

Log Regression-Based Risk Models

Why It's Flawed

Normalizes price, social, and on-chain data into a composite risk score.

How EdgeVector Line Solves it

Linear scaling doesn't adjust for real market dynamics. Fitting price to a log curve assumes past patterns repeat perfectly

Normalization & Aggregation Models

Why It's Flawed

Weights multiple factors (price, social, on-chain) into a single score. Looks sophisticated but is just linear scaling.

How EdgeVector Line Solves it

EdgeVector Line doesn't rely on static weights - it recalibrates dynamically based on real market shifts

Quant-Based Sentiment Models

Why It's Flawed

Tracks Twitter followers, YouTube subs, and other social trends.

How EdgeVector Line Solves it

Momentum chasers get wrecked when sentiment shifts. EdgeVector Line focuses on actual market positioning