How to Evaluate any Trading System: Separating Edge from Hype

Avoid These Common Pitfalls; Build a System That Wins Over Time

Most traders lose money. That’s not an opinion - it’s a statistical inevitability.

Is it because most traders are lazy? No. Or because most traders are just plain dumb? No.

It’s because nearly all so-called “trading systems” are just randomness in a suit. Or as I like to call them - turds in tuxedos. Dressed to impress but shit underneath.

Of course, these systems try hard by using buzzwords like “momentum,” “confirmation,” and “trend” - but underneath, they lack the one thing that actually matters:

A measurable, statistical edge.

In this note, we break down how YOU can tell whether a trading strategy is built to win over time - or if it’s just another repackaged set of chart patterns and moving averages that will leave you broke, confused and disappointed again.

The #1 Reason Most Traders Fail: No Systematic Edge

Facts:

· Having a real edge means your system has a long-lived, repeatable, measurable statistical advantage.

· A long-term successful trading system must quantify risk and reward based on probabilities, not gut feelings, astrology or lines on charts or horoscopes.

· A long-term successful trading system must adapt dynamically as market conditions change.

Most trading systems fail this test. And they fail miserably. But you already know that.

1. The Moving Average Trap:

"Price is above the 20-day EMA - time to buy."

"The 50 MA just crossed the 200 - golden cross!"

You’ve seen it before. You may even know it to be the core, underlying logic behind systems like CTO Larsson’s Line - a glorified moving average crossover “system” that sells for $2900. Buy when shorter MA crosses above longer MA, sell when it crosses back down. Sounds simple. Feels safe. But let’s be honest:

It’s trend-following dressed as insight. It tells you what already happened, not what’s likely to happen next. It breaks down in choppy, sideways markets, and is late for parabolic moves.

Nice try, but there’s no edge to be found here.

2. The Aggregation Illusion:

There’s a new breed of pseudo- quant out there.

They wrap charts in logarithmic regression curves. They aggregate metrics across price, on-chain data and social media data. Then casually normalize volatility into “risk bands.”

You even get some nice graphs along the way – with an easy-to-wrap-your-head-around “Risk Score” between 0 and 1.

It all sounds so smart. But it doesn’t tell you what to do today.

Systems like Ben Cowen’s log regression model tell you what the market has done over the last decade.

But trading happens in the next 24–72 hours.

You don’t need to know where BTC should be in 2030 – accordingly to some curves on a chart.

You need to know whether today’s setup has positive Expected Value, EV.

Nice try, but there’s no edge to be found here either.

3. The “Wait for Confirmation” Illusion

"Once price breaks above resistance, I’ll enter."

"If volume spikes, I’ll take the trade."

Waiting for confirmation feels safe - but it often just means you’re chasing. Late to the party – which wrecks your ability to manage risk effectively.

4. The BTC Pair Strength Myth

"If this altcoin is outperforming BTC, it must be strong."

Relative strength is a useful filter, but on its own, it doesn’t prove a setup has EV. And even if it did have positive EV, you don’t know how positive it is. Which means you can’t prioritize the trade relative to other trades or assess opportunity cost. So, you can’t manage your risk at the portfolio level, either.

Bottom line: most traders are reacting to price, not evaluating whether a trade has edge.

Why Trend-Following Isn’t a Strategy (and How to Fix It)

Yes, trend-following has its place. But on its own? It’s not a strategy. It’s risk control dressed up as edge.

Because:

· It doesn’t assign probability to trade outcomes.

· It doesn’t evaluate the quality of a trend - merely its presence.

· It falls apart in sideways or volatile conditions.

To build a real system, you need three things:

1. Probabilistic Trade Evaluation

Instead of asking, “Is this bullish?”, instead ask: “What’s the EV of this setup?”

EV = Expected Value, the most important probability- weighted, profitability metric in trading.

A setup isn’t “good” because it looks good. It’s good because:

· It’s been tested.

· It has a history of delivering positive EV.

· It fits within a broader strategy of risk-weighted decision-making.

2. Systems That Measure Edge, Not Just Entries

"Triple confirmation" might sound cool, but unless it comes with data like…

· Win rate

· Average R:R

· Drawdown profile

…it’s just cosmetic logic.

Your system should be able to say:

"When X condition occurs, Y is the expected outcome across a statistically significant number of trades to make the setup meaningful and confidently tradable."

3. Dynamic Recalibration

Market cycles evolve. The nature of cycles is changing. In the future, maybe we won’t have cycles. Or maybe we will, but they will be longer. Or shorter. And regardless of how cycles evolve, we can certainly say that what works in a bull run won’t work in a chop- heavy sideways market or a bleeding bear market.

Therefore, your system must recalibrate based on:

- Volatility conditions

- Regime shifts

- Macro structure changes

A fixed strategy will always die. An evolving one adapts, survives and thrives.

The 3 Core Principles of a Winning Trading System

1. Probabilistic Trade Evaluation

· Every trade should have a calculated EV.

· Your entries aren’t based on feelings - they’re based on statistically modeled opportunity.

· This means that you can select the best setups to trade, but ranking the setups by EV

· So, EV-based systems help you focus on asymmetric risk/reward setups, not interesting patterns on shiny charts.

2. Strategic Position Sizing

Risk management isn’t just about stop losses. It’s about how much you bet.

· High-EV trade? Bet bigger.

· Low-confidence setup? Bet smaller - or skip entirely, in favor of a trade with a higher EV setup.

Dynamic sizing means your capital flows to where the edge actually resides. That’s how poker pros, hedge funds, and quants play. Retail traders? They’ll so often bet the same on every hand. And if not, trade sizing is often left to “gut feel”.

3. Adaptive Learning & Recalibration

· Your system must be a living organism.

· Models must be regularly backtested, models, constantly validated against updated assumptions, and assessed against unseen data with walk forward analysis to keep it sharp.

· What’s working this month might be noise next month.

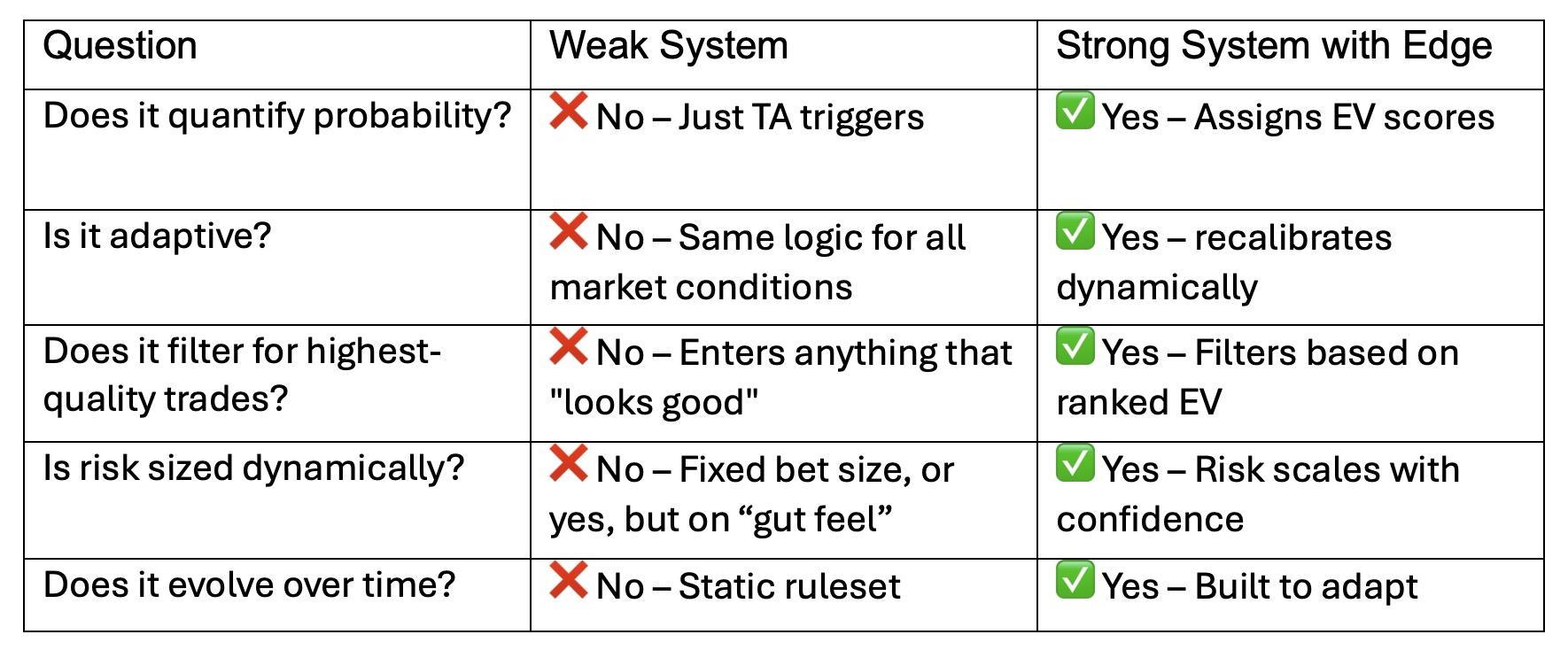

A Simple Checklist: How to Evaluate Any Trading System

Assess your trading system against these basic criteria

If your system fails any of these- It most likely has no edge.

Which means you’re the exit liquidity of those who do have edge.

Final Takeaway: Most Traders Are Exit Liquidity

If you’re not operating with a **quantified, dynamic, edge-based system**, you’re not trading—you’re gambling.

Most retail systems are just trend-chasing with better branding.

They look smart, and they may even some with some fancy buzzwords thrown in, but they’re not statistically backed.

Your system needs a PhD to explain but still can’t tell you when to bet bigger and when to sit in cash? Then it’s not quant. It’s cosplay.

What Now?

This note wasn’t about selling you a specific strategy. Rather, it’s designed to give you a framework to evaluate any trading system. Because now you know what a real edge looks like.

And the next time someone says “Our strategy uses triple confirmation and trend momentum with BTC pair strength” or “we use an advanced method which fuses logarithmic regression, aggregation and normalization together”, you can say: “Lovely. So, what’s the EV of your last 100 trades then?”

That’ll separate the pros from the peddlers.

If you want to see what a probability-based, recalibrating system actually looks like in crypto…

Explore the EdgeVector Line — the first crypto trading framework to quantify edge It’s built entirely on EV, poker logic, Game Theory and stochastic calculus.